Tax Computation Worksheet for Line44 Before you begin. If the amount on line 2 is less than 100000 use the Tax Table to figure this tax.

Foreign Earned Income Tax Worksheet

Tax Computation Worksheet for Line44.

2017 tax computation worksheet line 44. Simplified Method Worksheet Lines 16a and 16b. Use Form 8615 to calculate the tax for dependent child income over 2000. Ad The most comprehensive library of free printable worksheets digital games for kids.

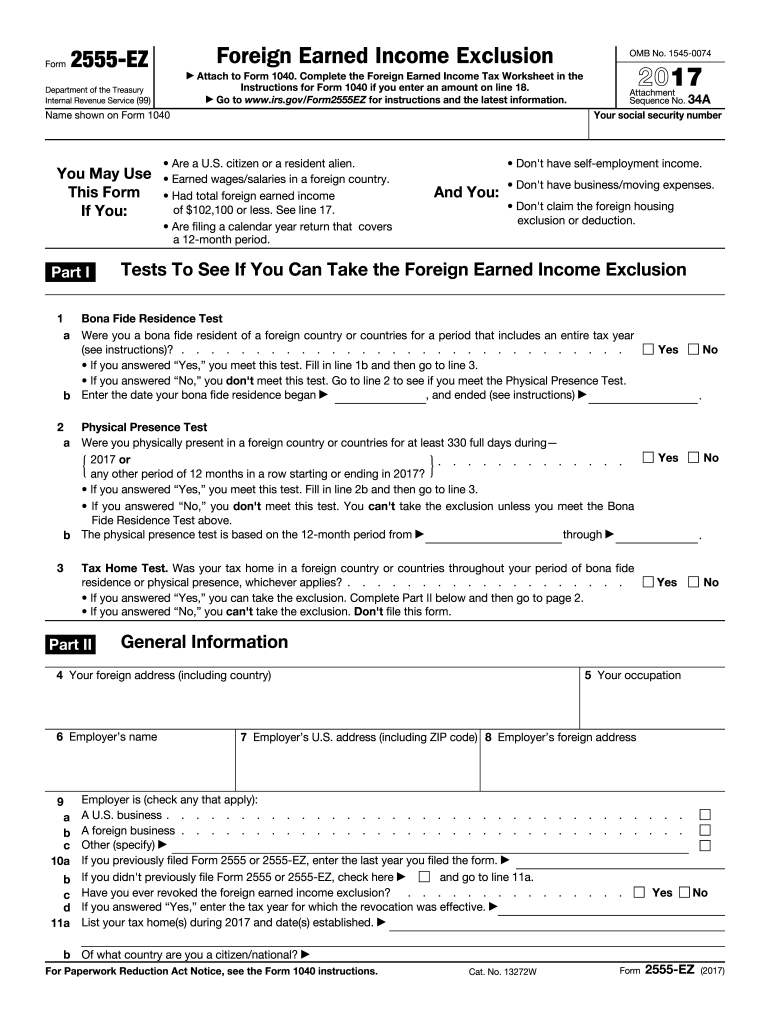

You must use the Foreign Earned Income Include in the total on line 44 all of theHowever do not use the Tax Table orTax Worksheet on page 36 instead. Student Loan Interest Deduction Worksheet Line 33. Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10.

If you did not complete either worksheet. Income on Form 1040 line 43 is 25300. See instructions for how to figure the amounts to enter on the lines below.

The box that is. For instance if there are long-term Capital Gains- taxes on line 44 are calculated using the worksheet -. _____ COLUMN 1 COLUMN 2 COLUMN 3 Originally ReportedAdjusted Net Change Correct Amount COMPUTATION OF GENERAL CORPORATION TAX GENERAL CORPORATION TAX WORKSHEET OF CHANGES IN TAX BASE.

The IRS instructions for Form 1040 line 44 starting in the right column on page 41 explain the conditions for using each of the 7 methods. Since you are using the CD or download TurboTax software you can look at Form 1040 in forms mode to see which method TurboTax used. Local poverty level credit from Local Poverty Level Credit Worksheet in Instruction 19.

Also include this amount on Form 1040 line 44. Extend certain tax benefits that expired at the end of 2016 and that currently cant be claimed on your 2017 tax return such as. First they find the 25300-25350 taxable income line.

Tax on all taxable income. Be relevant if you purchased health insurance coverage for 2017 through the Health Insurance Marketplace and wish to claim the premium tax credit on line 69. If filing Form NYC-4SEZ enter zero 0.

Generally - taxeson line 44 is determined from taxtablesbased on the taxable incomeline 43 - see tax tables here - wwwirsgovpubirs-pdfi1040ttpdf. Hi and welcome to JustAnswer. If your taxable income is under 100000 use the IRS Tax Table to determine the tax rate for line 44.

See the instructions for line 44 to see which tax computation method applies. Next they find the column for married filing jointly and read down the column. Social Security Benefits Worksheet Lines 20a 20b.

Tax Calculator for Tax Year 2017. Tax on the amount on line 2. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table.

Your social security number. Do not use a second Foreign Earned Income Tax Worksheet to figure the tax on this line 4. Line 44 taxable income is 100000 or more use amount to enter on Form 1040 line 44.

But the Tax Computation Worksheet on if you are filing Form 2555 or 2555-EZ Tax page 86. This Tax Calculator lets you calculate your 2017 IRS Taxes. Estimate prepare and e-File your 2019 Taxes now.

Part I Short-Term Capital Gains and LossesAssets Held One Year or Less. State and Local Income Tax Refund Worksheet. You can no longer e-File your 2017 Tax Return.

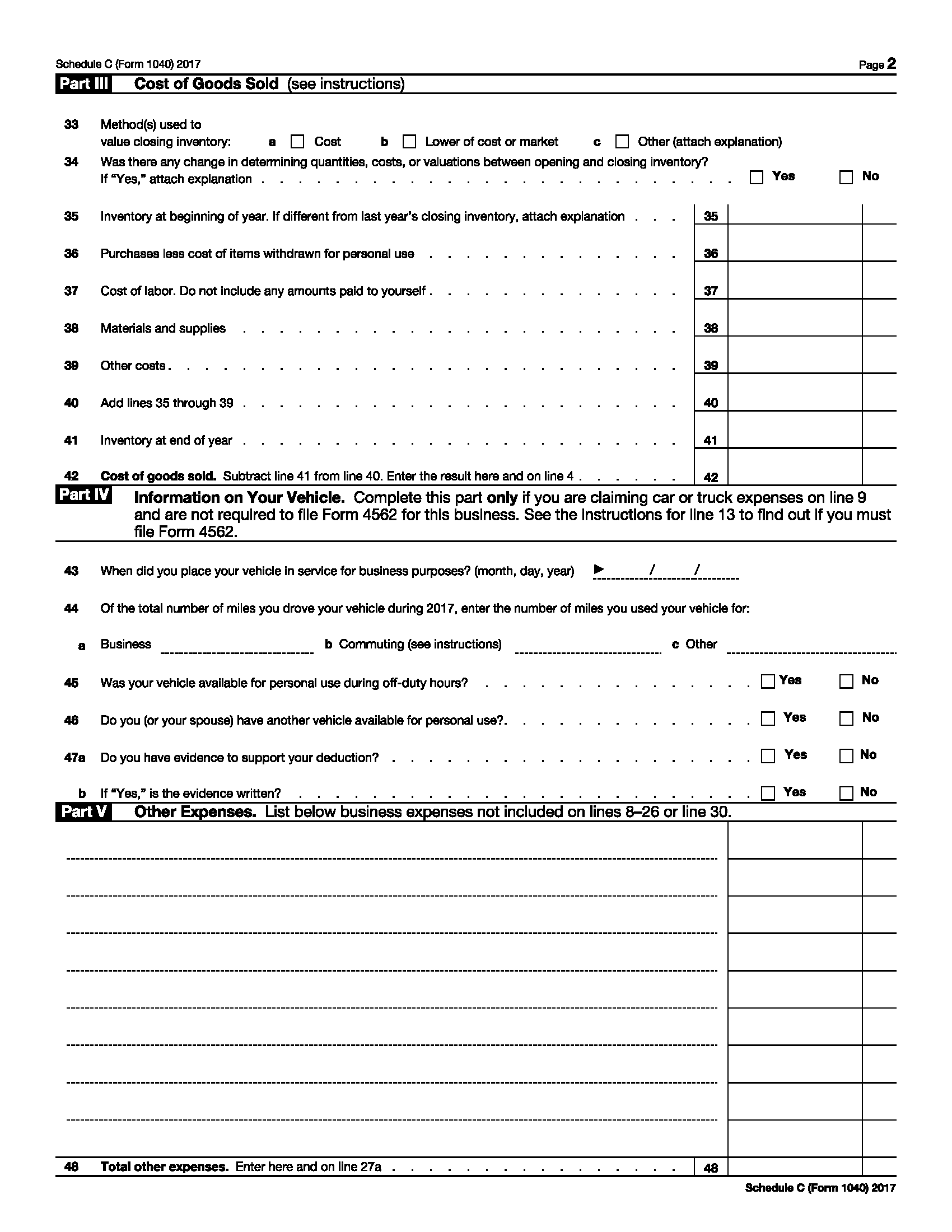

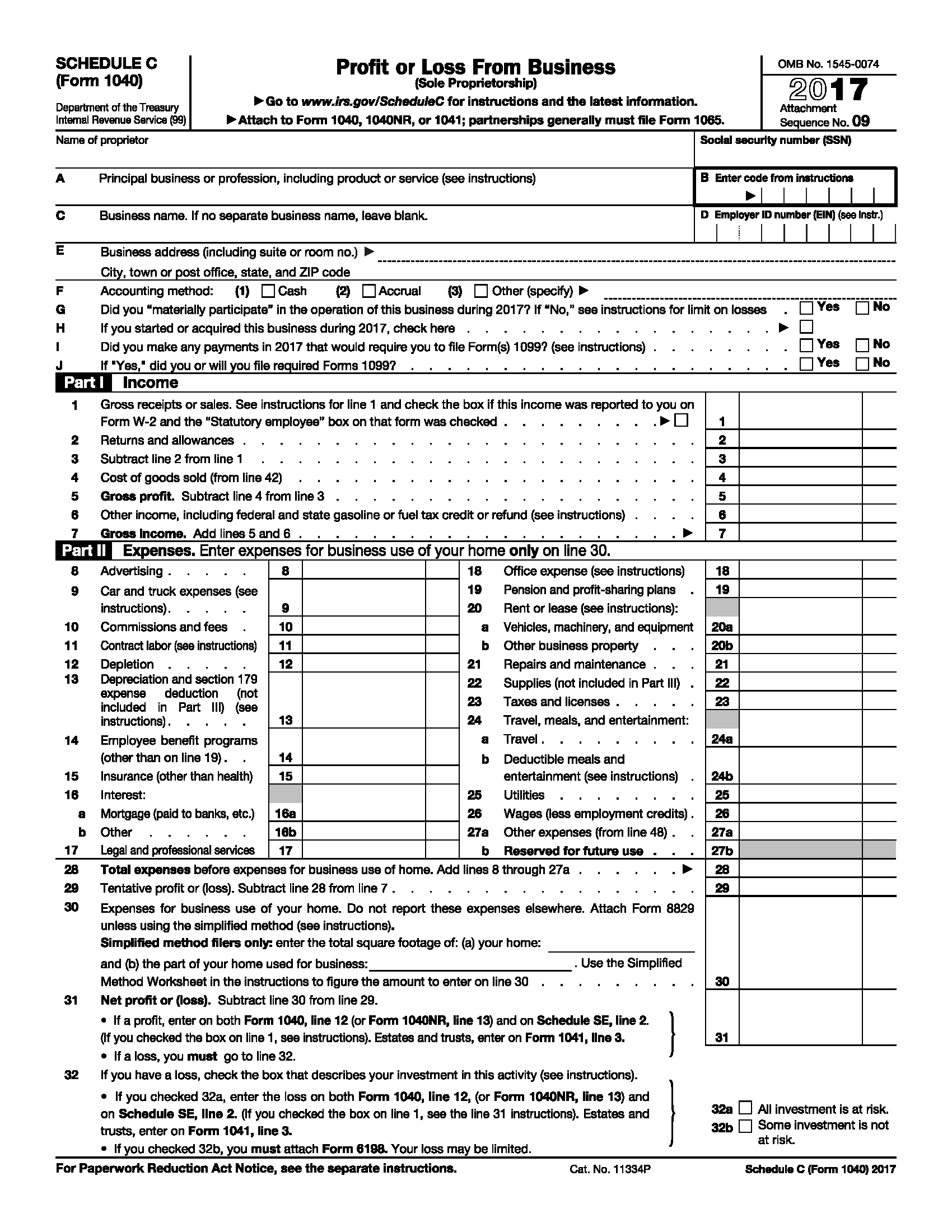

The Schedule D Tax Worksheet is used to calculate tax on lump sum distributions and capital gains when lines 18 or 19 exceed zero. The amount shown where the taxable income line and filing status column meet is 2866. Instead enter it on line 4 of the Foreign Earned Income Tax Worksheet 27.

If you don t wish to claim the. You may rely on other information received from your employer. Alternative tax multiply line 38 by applicable tax rate of 885.

If the amount on line 1 is 100000 or more use the Tax Computation Worksheet. There are situations when taxes are calculated differently. If you are filing Form 2555 or 2555-EZ do not enter this amount on Form 1040 line 44.

August 23 2017. And tax relief for those affec-ted by other 2017 disasters such as the California wild-fires. If line 43 taxable.

Search for your 2017 state forms. Ad The most comprehensive library of free printable worksheets digital games for kids. Multiply line 20 by your local tax rate0 or use the Local Tax Worksheet.

Local earned income credit from Local Earned Income Credit Worksheet in Instruction 19. The credit for nonbusi-ness energy property b. This is the tax amount they should enter on Form 1040 line 44.

Get thousands of teacher-crafted activities that sync up with the school year. Names shown on return. Standard Deduction Worksheet for Dependents Line 40.

Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 44 or the amount from line 19 of the Schedule D Tax Worksheet whichever applies as figured for the regular tax. Parts of the credit for res-idential energy property c. Get thousands of teacher-crafted activities that sync up with the school year.

Local tax credit from Part L line 1 of Form 502CR. Enter the smaller of line 25 or line 26. However you don t need to wait to receive this form to file your return.

If its 100000 or more use the Tax Computation Worksheet. The Tax Smart Worksheet between lines 43 and 44 of Form 1040 has 7 checkboxes for the 7 different methods.

Https Elections Cdn Sos Ca Gov Statewide Elections 2021 Recall Tax Returns John Cox 2017 Pdf

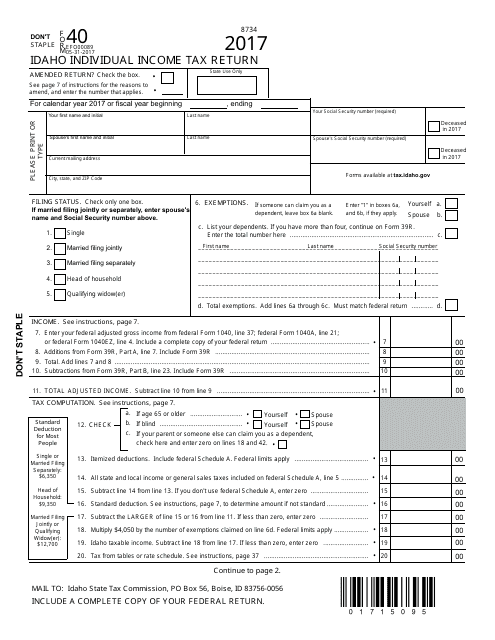

Form 40 Download Fillable Pdf Or Fill Online Idaho Individual Income Tax Return 2017 Idaho Templateroller

Foreign Earned Income Tax Worksheet

Line 44 No Tax Or Tax Different Than Tax Table In Ultimatedr Ultimatetax Solution Center

Part 8 2017 Sample Tax Forms J K Lasser S Your Income Tax 2018 Book

Tax Computation Worksheet Fill Online Printable Fillable Blank Pdffiller

2018 Tax Changes By Form Taxchanges Us

Part 8 2017 Sample Tax Forms J K Lasser S Your Income Tax 2018 Book

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money

Part 8 2017 Sample Tax Forms J K Lasser S Your Income Tax 2018 Book

Invoice Template Payment Terms Free Printable Invoice Payment Conditions For Invoice Invoice Template Printable Invoice Quotation Template

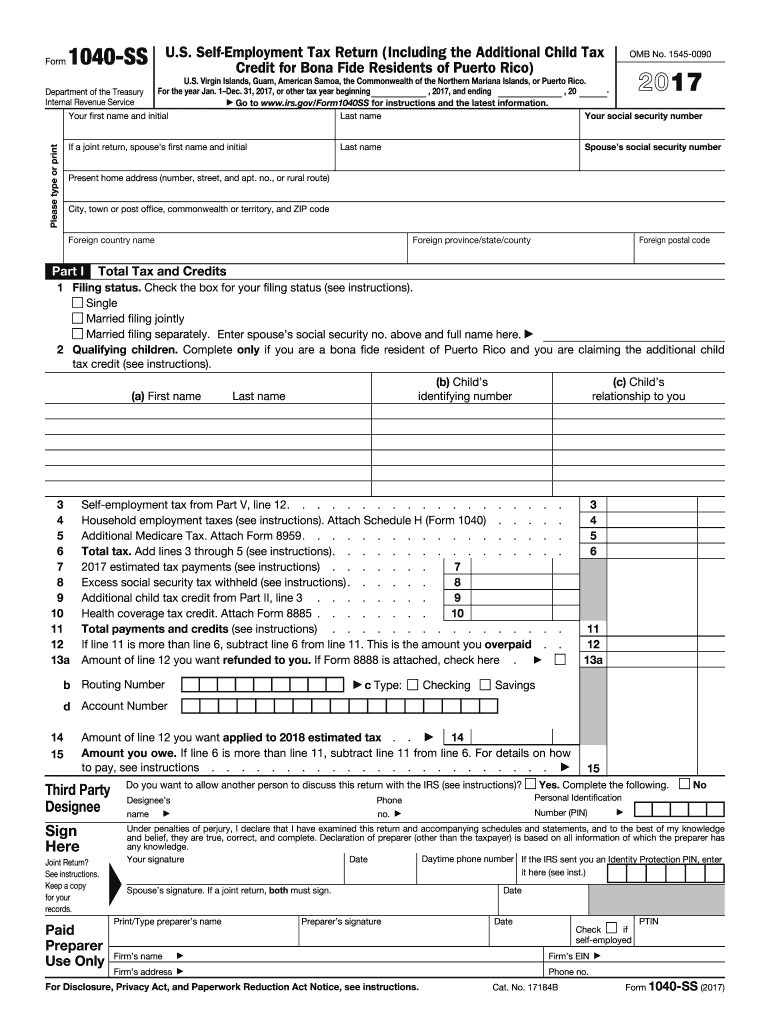

2017 Form Irs 1040 Ss Fill Online Printable Fillable Blank Pdffiller

Part 8 2017 Sample Tax Forms J K Lasser S Your Income Tax 2018 Book

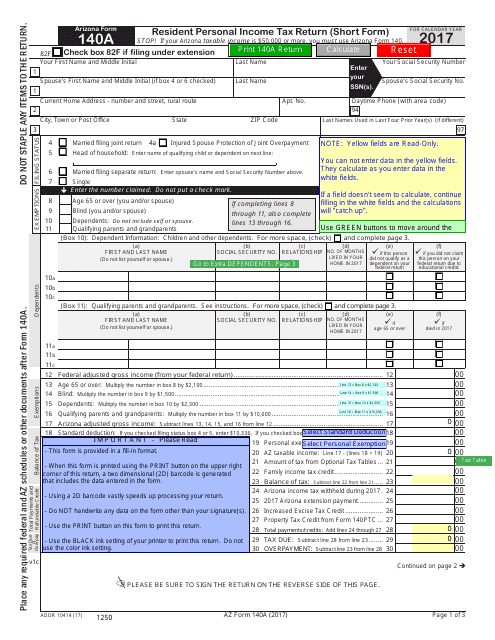

Arizona Form 140a Ador10414 Download Fillable Pdf Or Fill Online Resident Personal Income Tax Return Short Form 2017 Arizona Templateroller

Part 8 2017 Sample Tax Forms J K Lasser S Your Income Tax 2018 Book

2018 Tax Changes By Form Taxchanges Us

Https Elections Cdn Sos Ca Gov Statewide Elections 2021 Recall Tax Returns John Cox 2017 Pdf

Https Elections Cdn Sos Ca Gov Statewide Elections 2021 Recall Tax Returns John Cox 2017 Pdf

No comments: